Which Item May Not Be Cited as a Precedent

Which item may not be cited as a precedent a. Which item may not be cited as a precedent.

Tax Court decision e None of the above.

. Issued as Proposed Regulations. Pursuant to section 6110k3 this document may not be used or cited as precedent. Paragraph designation Code Citations Symbols.

District Court decision e. May not be cited as a precedent. This problem has been solved.

Which item may not be cited as a precedent. Which item may not be cited as a precedent. In 2121 the number 1 stands for the.

QUESTION 12 Which item may not be cited as a precedent. Issued as Proposed Regulations. May not be cited as precedent.

Technical Advice Memoranda d. Which item may not be cited as a precedent. District Court decision QUESTION 13 Primary tax law.

Which item may not be cited as a precedent. It basically works as an example or analogy for. Which item cannot be cited as a precedent.

15CV70501 In the Case of2. Pages 5 This preview shows page 1 - 3 out of 5 pages. This advice may not be used or cited as precedent.

Course Title ACC 410. See the answer See the answer done loading. 2 a 1 A Examples Code Citation.

Which item may not be cited as a precedent. A Regulations b Temporary regulations c Technical advice memoranda d US. What statement is not true with respect to Temporary Regulations.

Writing may undermine our ability to. Deductions for the portion of the flight allocable to persons accompanying the sole proprietor may be further reduced under 274m3 and 1162-2c. May not be cited as precedent.

May not be cited as precedent. In a legal context a precedent is a judicial decision that constitutes an authoritative example for subsequent similar cases. CHAPTER 2 Working With The Tax Law a.

Which item may not be cited as a precedent. Who are the experts. A Regulations b Temporary regulations c Technical advice memoranda d US.

District Court decision e. IRS instructions for Form 1040 d. Technical Advice Memoranda d.

Which item may not be cited as a precedent a Regulations b Temporary Regulations. Automatically expire within three years after the date of issuance. Issued as Proposed Regulations.

Issued as Proposed Regulations. May not be cited as precedent. See the answer See the answer See the answer done loading.

Issued as Proposed Regulations. Automatically expire within three years after the date of issuance. Regulations cTemporary Regulations d.

Which item may not be cited as a precedent. What statement is not true with respect to Temporary Regulations. Colorado Court of Appeals 2 East 14th Avenue Denver CO 80203 Appeal from1 Larimer County District Court District Court Judge.

What statement is not true with respect to Temporary Regulations. The IRS will not acquiesce to the following tax decisions. On July 13 2021 the Swedish Supreme Court held that an attorney who had passed along information from an arrested client with full restrictions had seriously breached proper attorney conduct på ett allvarligt sätt åsidosatt god advokatsed and should be disbarredSupreme Court Ö 5090-20 July 13 2021 CaseAccording to the Swedish Code of.

Which item may not be cited as a precedent. A common idiom is to set a precedent. Technical Advice Memoranda d.

What statement is not true with respect to Temporary Regulations. Technical Advice Memoranda d. May not be cited as precedent.

In addressing the importance of a Regulation an IRS agent must. Found in the Federal Register E. Which item may not be cited as a precedent.

District Court decision e. Tax Court decision e None of the above. Found in the Federal RegisterE.

C Technical Advice Memoranda. Automatically expire within three years after the date of issuance. Issued as Proposed Regulations.

Give equal weight to the Internal Revenue Code and the Regulations. All of the above are correct citations. IRS instructions for Form 1040 b.

Fhair District Court Case Number. Which of the following is not a correct citation of the Internal Revenue code. What administrative release deals with a proposed transaction rather than.

All of the above statements are true. A precedent is a previous instance taken as an example or rule by which to be guided in similar cases or circumstances. Which statement is not true with respect to temporary regulations.

May not be cited as precedent. Small Case Division of the US. Provides in part that the recurring item exception does not apply to any liability of a taxpayer described in paragraph g7 other liabilities of 1461-4.

A precedent refers to a decision taken by a court that is cited in further conflicts or disputes for making a judgment in a similar type of case. Brief do not necessarily represent the views of any division of the Court of Appeals and the brief may not be cited as precedent. District Court decision e.

This advice applies only under the facts and circumstances described herein.

A Man And His Sons Clearing A Field Of Land Mines In Afghanistan So They Can Farm It Dfid Uk Department Of International Development Flickr Pinterest

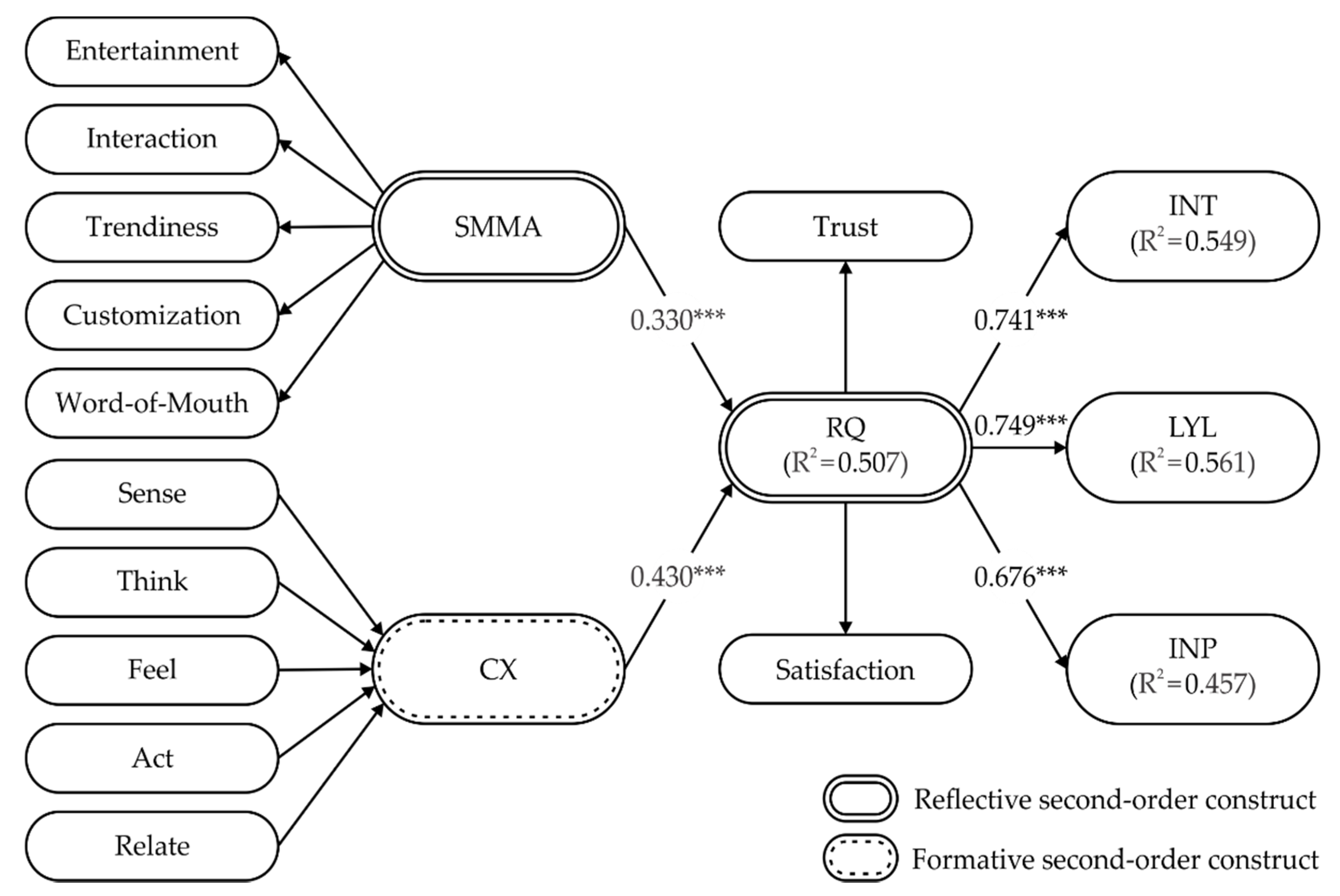

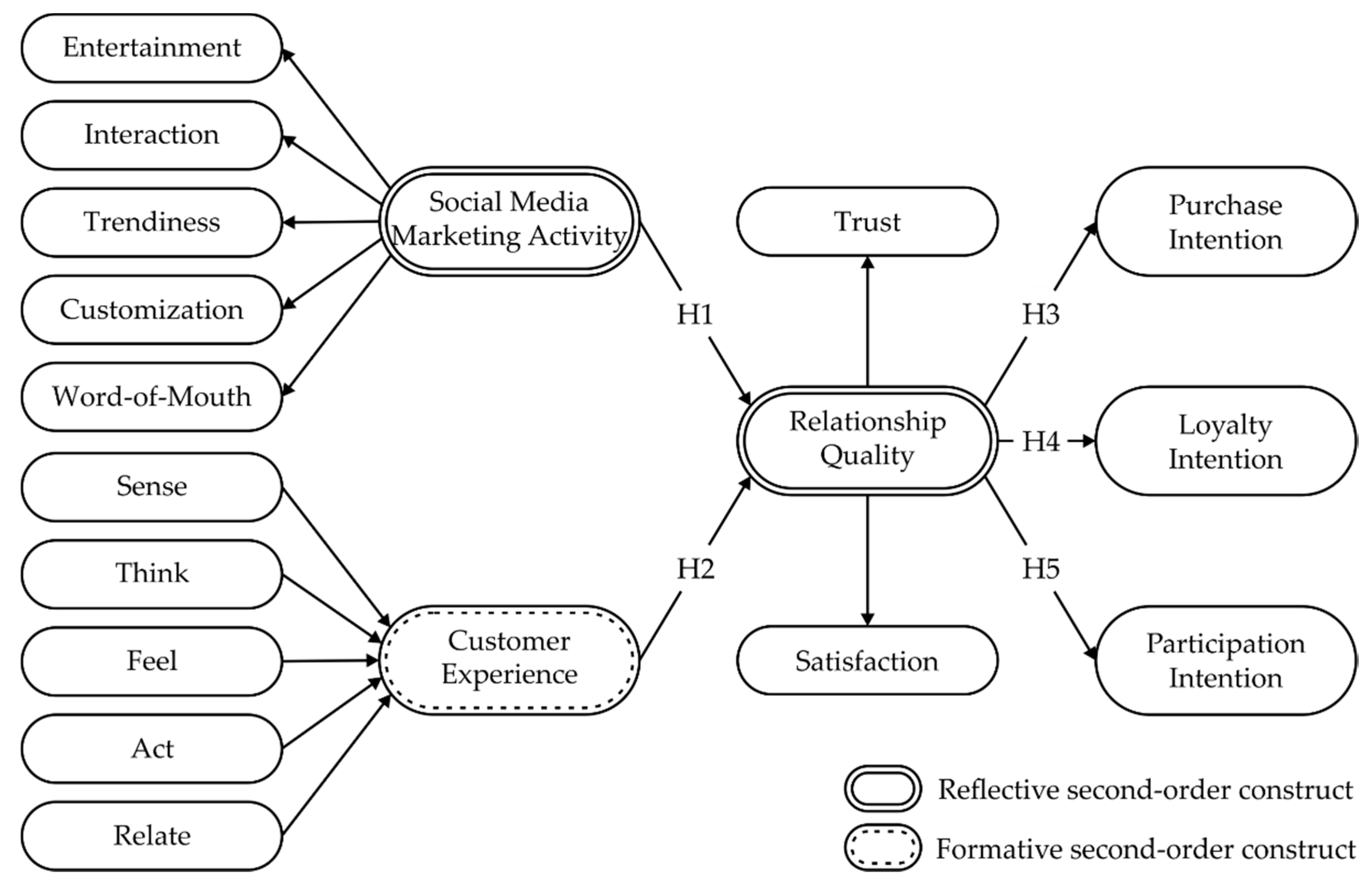

Sustainability Free Full Text Customer Behavior As An Outcome Of Social Media Marketing The Role Of Social Media Marketing Activity And Customer Experience Html

A Man And His Sons Clearing A Field Of Land Mines In Afghanistan So They Can Farm It Dfid Uk Department Of International Development Flickr Pinterest

A Man And His Sons Clearing A Field Of Land Mines In Afghanistan So They Can Farm It Dfid Uk Department Of International Development Flickr Pinterest

Malaysia Says It Won T Sanction Russia For Invading Ukraine Benarnews

Sustainability Free Full Text Customer Behavior As An Outcome Of Social Media Marketing The Role Of Social Media Marketing Activity And Customer Experience Html

The Atomic Bomb Is What States Make Of It A Constructivist Approach To Sanctioning Iran The Yale Review Of International Studies

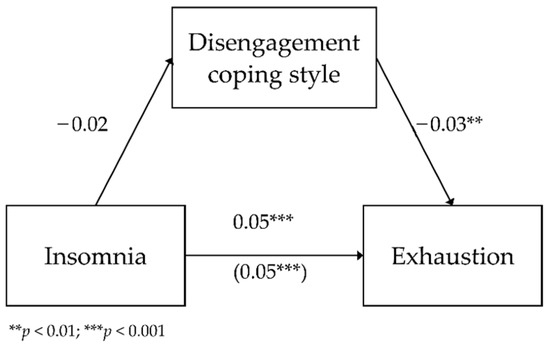

Ijerph Free Full Text Insomnia Among Prison Officers And Its Relationship With Occupational Burnout The Role Of Coping With Stress In Polish And Indonesian Samples Html

No comments for "Which Item May Not Be Cited as a Precedent"

Post a Comment